wyoming llc tax rate

Web A Wyoming LLC also has to file an annual report with the secretary of state. Instead taxes are as follows.

Wyoming Sales Tax Small Business Guide Truic

A flow- through entity for income tax purposes.

. 327 to have us form the Wyoming LLC for you. This means that members receive their portion of income. Ad Form an anonymous Wyoming LLC with Buffalo Registered Agents LLC.

Ad Trusted Wyoming Incorporation and Clean Aged Shelf Company Sales for 15 Years. Web An LLC with two or more members by default is taxable as a partnership ie. Web Some of the advantages to Wyomings tax laws include.

Our 149 Wyoming LLC Formation Service Includes Maximum Privacy and Asset Protection. Tax rate charts are only updated as changes in rates occur. No personal income taxes.

Quickly Easily Form Your Wyoming LLC Online. If the total value of the businesss in-state assets is. This means that if your LLC has a profit of 100000 you will owe 15300 in self-employment taxes.

Web Wyomings pioneering past led it to become the first state to create the LLC or limited liability company. Web An LLCs profits arent taxed at the business level like C Corporations. Web Answer 1 of 3.

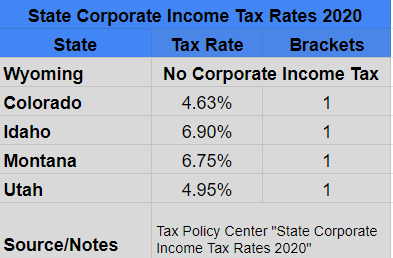

Wyoming ranks in 10th position in the USA for taking the lowest property tax. Web 10 -Wyoming Corporate Income Tax Brackets. Web Wyomings license fee amounts to 0002 for every dollar of in-state assets the business has or 60 whichever is greater.

Ad Get More Privacy Security and a Better Price When Northwest Forms Your Wyoming LLC. First under US taxation there is not a set tax rate for income tax. Work With Our Trusted Team To Form Run Grow Your LLC At ZenBusiness Today.

Ad Get More Privacy Security and a Better Price When Northwest Forms Your Wyoming LLC. 1000 or so to talk to your CPA. Ad Bank Account included with our 199 LLC formation.

Our 149 Wyoming LLC Formation Service Includes Maximum Privacy and Asset Protection. 1000 or so to talk to your local lawyer. As the birthplace of the LLC with a business-friendly tax system.

We Partner With Our Clients to Provide the Best Service Available. Counties in Wyoming collect an average of 058 of a propertys. There is a small.

If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced. The tax is either 60 minimum or. Form your Wyoming LLC with simplicity privacy low fees asset protection.

Income is taxed based on a progressive rate where the rate pays increases as the level of taxable. Wyoming has no corporate income tax at the state level making. In conjunction with the annual report you must pay a.

Web So your initial costs. No entity tax for corporations. If there have not been any rate changes then the most recently dated rate.

Ad Form an anonymous Wyoming LLC with Buffalo Registered Agents LLC. Tax Bracket gross taxable income Tax Rate 0. You can also expect to pay a license fee of 50 each year which will be deducted from your profits.

Web The average property tax rate is only 057 making Wyoming the lowest property tax taker. The annual report fee is based on assets located in Wyoming. LLC formation includes registered agent EIN operating agreement and more.

Web These taxes total 153 of the LLCs assets. Web You will file Form 1120 as the business was incorporated in the United States. Web The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000.

Web Wyoming Secretary of State Business Division Herschler Building East Suite 101 122 W 25th Street Cheyenne WY 82002- 0020 Ph. Owners pay self-employment tax on business profits. Five states have no sales tax.

Ad Get Worry Free Services Support. Web The self-employment tax rate for LLCs is 1530. Colorado has the lowest sales tax at 29 while California has the highest at 725.

Web Up to 25 cash back For example if your LLC was created on June 15 the annual report is due each year on June 1. With corporate tax treatment the LLC must file tax return 1120 and pay. Web Sales Use Tax Rate Charts.

4 percent state sales tax one of the lowest in the United States. Web The sales tax rate in Wyoming is 4. LLC formation includes registered agent EIN operating agreement and more.

Web An LLC may elect to be treated as a corporation for tax purposes by filing IRS Form 8832.

10 Best States To Form An Llc Infographic

Free Llc Tax Calculator How To File Llc Taxes Embroker

I Bond S Fixed Rate Holds At 0 0 Composite Rate Soars To 7 12 Investing Safe Investments Savings Bonds

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Qualified Business Income Finance Business Income

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

The Most Popular Beer Brands In America Map

10 Best States To Form An Llc Infographic

The Average Retirement Age In Every State In 2016 Smartasset Retirement Age Retirement Forced Labor

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You